nassau county sales tax rate 2020

How do you calculate local sales tax. Groceries are exempt from the Nassau County and Florida state sales taxes.

How To Calculate Fl Sales Tax On Rent

The Nassau County sales tax rate is 425.

. The minimum combined 2022 sales tax rate for Nassau County New York is 863. Welcome to Nassau Countys official website. The Nassau County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Nassau County local sales taxesThe local sales tax consists of a 100 county sales tax.

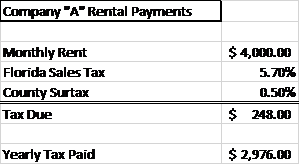

How much is NY Sales Tax 2020. This is the total of state and county sales tax rates. However most people will pay more than 55 because commercial rent is also subject to the local surtaxes at a rate where.

425 which is forwarded to the County of which 25 is. The current total local sales tax rate in Los Angeles CA is 9500. Has impacted many state nexus laws and sales tax collection.

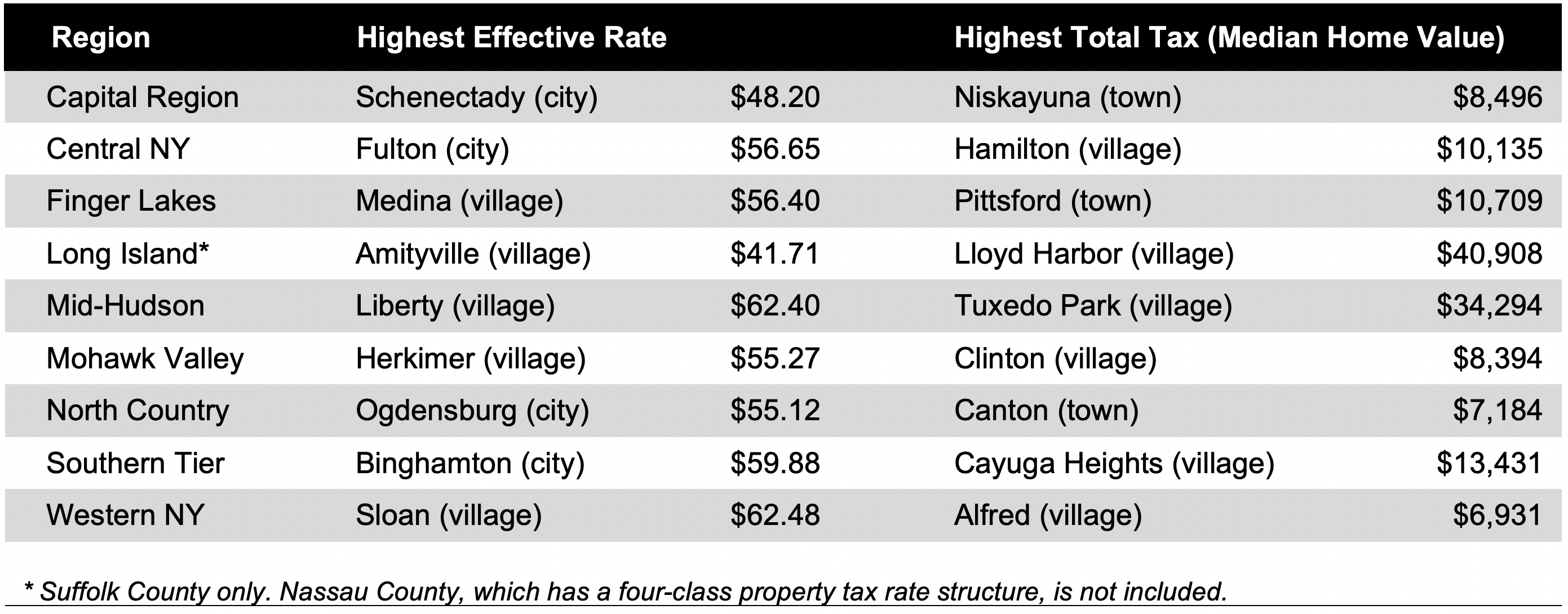

The mere fact that the County is not increasing the market value doesnt mean that these taxes wont increase especially as schools are forced to bear increased costs due to COVID safety measures. What is the local sales tax rate. The RPIA provides a five-year phase in for changes to a homeowners assessed value for the 202021 tax year caused by the countywide reassessment.

Contact the district representative at 409-684-6311 for additional boundary information. California 1 Utah 125 and Virginia 1. On February 15 th 2022 the Nassau County Treasurer will sell at public on-line auction the tax liens on certain real estate unless the owner mortgagee occupant of or any other party in interest in such real estate shall have paid to the County Treasurer by February 11 th 2022 the total amount of such unpaid taxes or.

The New York state sales tax rate is currently 4. On January 1 2020 the state tax rate was reduced from 57 o 55. 72 rows The plan has been to slowly but surely reduce the sales tax rate on commercial rent to zero and weve seen reductions in the tax rate for several years now.

518-485-2889 To order forms and publications. The Sales Tax rate for Nassau County is 865. New York State Comptroller Thomas DiNapoli has just released an analysis reporting that sales tax income for Nassau County dropped by 388 percent in May compared to receipts in 2019from 91.

Nassau County 4⅝. Fast Easy Tax Solutions. A City county and municipal rates vary.

The Nassau County Sales Tax is collected by the merchant on all qualifying sales made within Nassau County. The local sales tax rate in Nassau County is 1 and the maximum rate including Florida and city sales taxes is 75 as of April 2022. 4 which is retained by New York State.

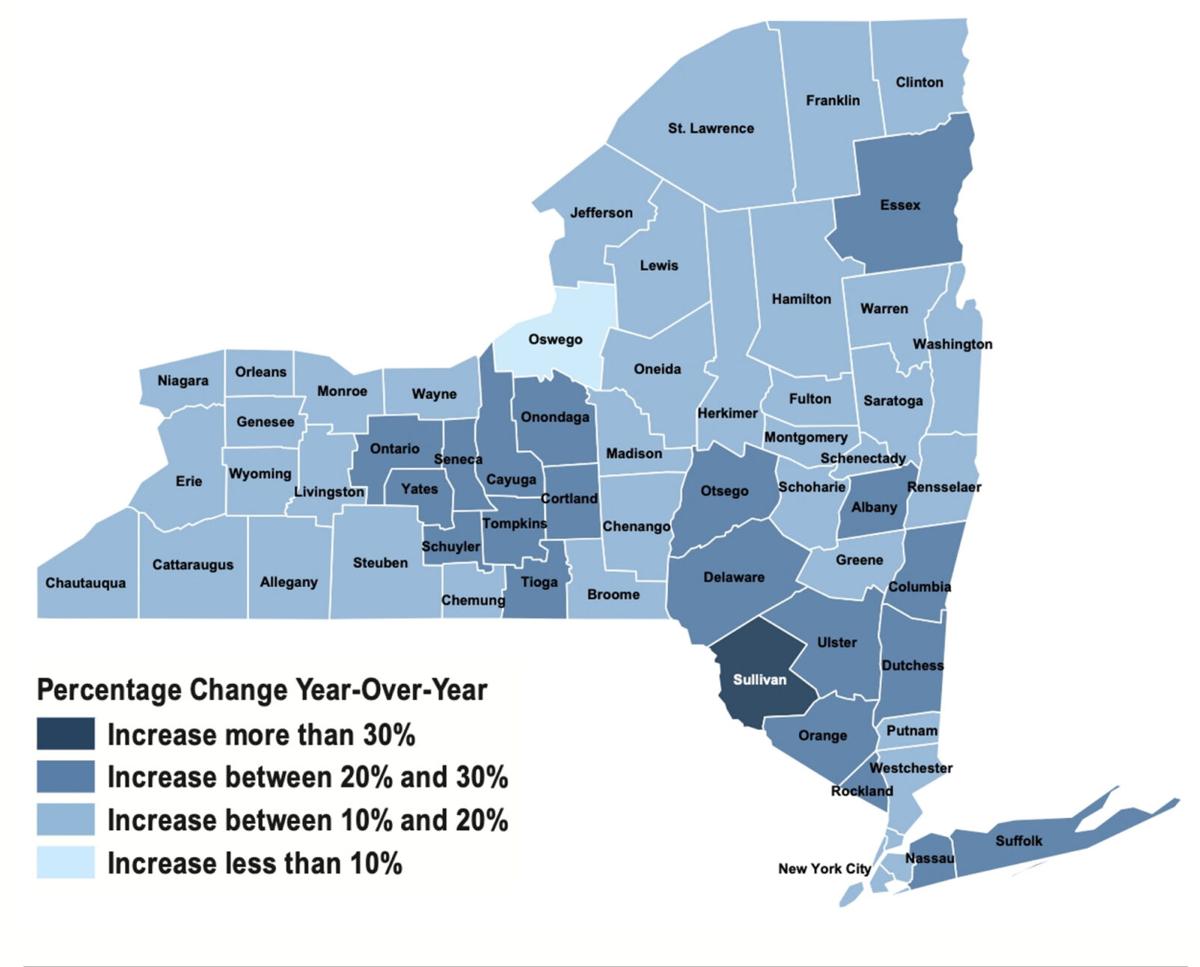

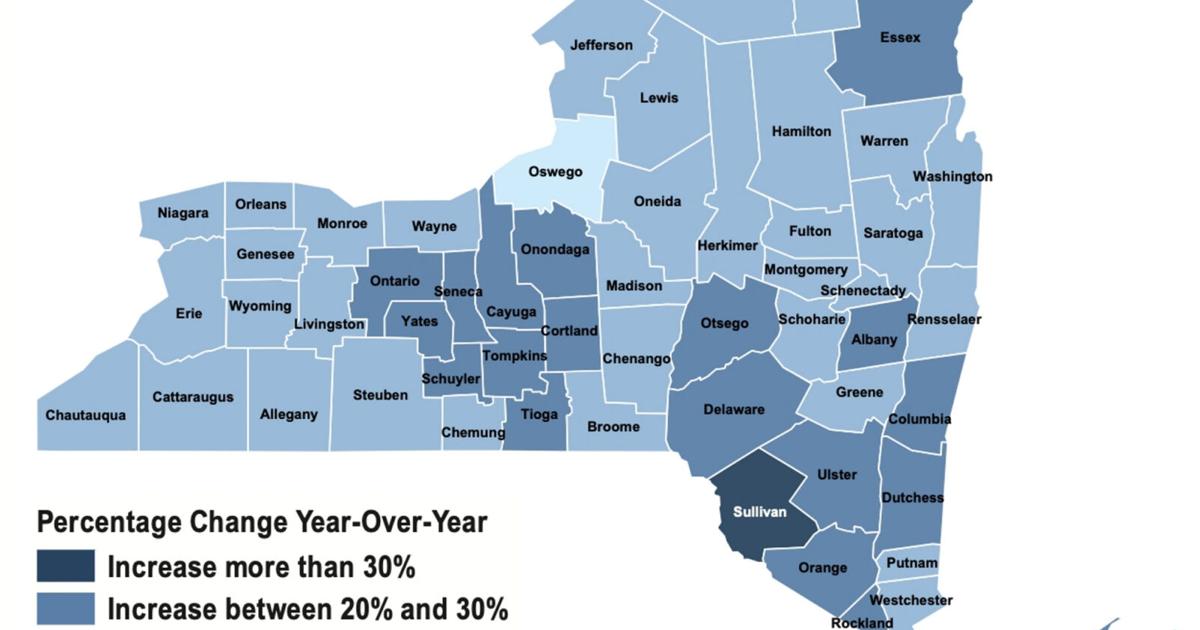

New York State Department of Taxation and Finance Tax and Finance Notes. Taxes on Selected Sales and Services in Nassau and Niagara Counties Report transactions for the period June 1 2020 through August 31 2020. Amid the COVID-19 pandemic sales tax revenue in Nassau County could drop 12 percent to 28 percent officials said Monday.

The 2018 United States Supreme Court decision in South Dakota v. This resource is designed to provide information about your county government the many services and recreational programs we offer and different ways we can provide assistance to the more than 14 million residents who live here. Nassau county sales tax rate 2020 Tuesday March 15 2022 Edit The exact property tax levied depends on the county in Virginia the property is located in.

Office of the Nassau County Comptroller. 74 rows The local sales tax rate in Nassau County is 0 and the maximum rate including. The December 2020 total local sales tax rate was also 8625.

This consists of three components. The Nassau County Sales Tax. Adina Genn May 18 2020.

Nassau County. B Three states levy mandatory statewide local add-on sales taxes at the state level. Nassau County NY Sales Tax Rate The current total local sales tax rate in Nassau County NY is 8625.

The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use Tax of 8875 percent. On March 23 2020 the Nassau County Legislature passed the Reassessment Phase-In Act of 2020 RPIA formerly known as the Taxpayer Protection Plan. State Local Sales Tax Rates As of January 1 2020.

Nassau County Annual Tax Lien Sale - 2022. Ad Find Out Sales Tax Rates For Free. Yates County 4 Taxing jurisdiction Tax rate Sales Tax Information Center.

To determine how much sales tax to charge multiply your customers total bill by the sales tax rate. Who must file Complete Form ST-1002 Quarterly Schedule A if you make sales or provide any of the taxable services listed below in Nassau County or Niagara County or both as follows. 518-457-5431 Text Telephone TTY or TDD Dial 7-1-1 for the.

375 is earmarked for the Metropolitan Transportation Authority. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. Thats according to Jack.

The current total local sales tax rate in Nassau County NY is 8625. These rates are weighted by population to compute an average local tax rate. View this measure last updated August 28 2019.

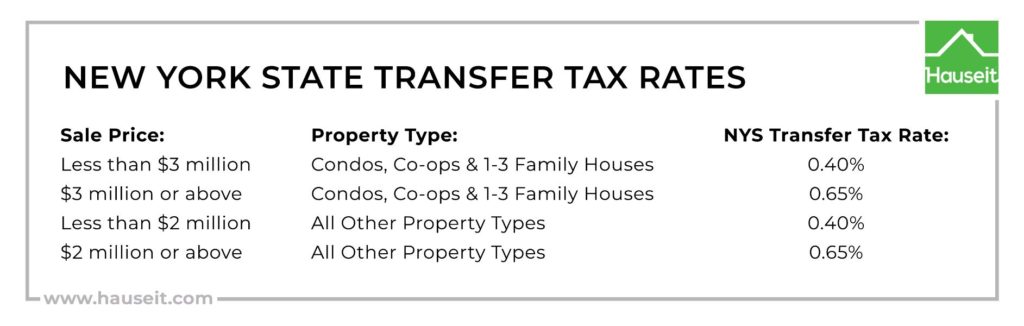

An additional tax rate of 0375 percent is imposed in New York City and in Dutchess Nassau Orange Putnam Rockland Suffolk. Download all New York sales tax rates by zip code. What the RPIA Does.

Sales tax rates in each county and city that imposes sales tax. According to media reports more than 60 percent of Nassau County homeowners will pay more in School Taxes in 2020 than they did in 2019. Total State and Local Sales Tax Rate by County as of January 1 2020 Source.

How To Calculate Sales Tax For Your Online Store

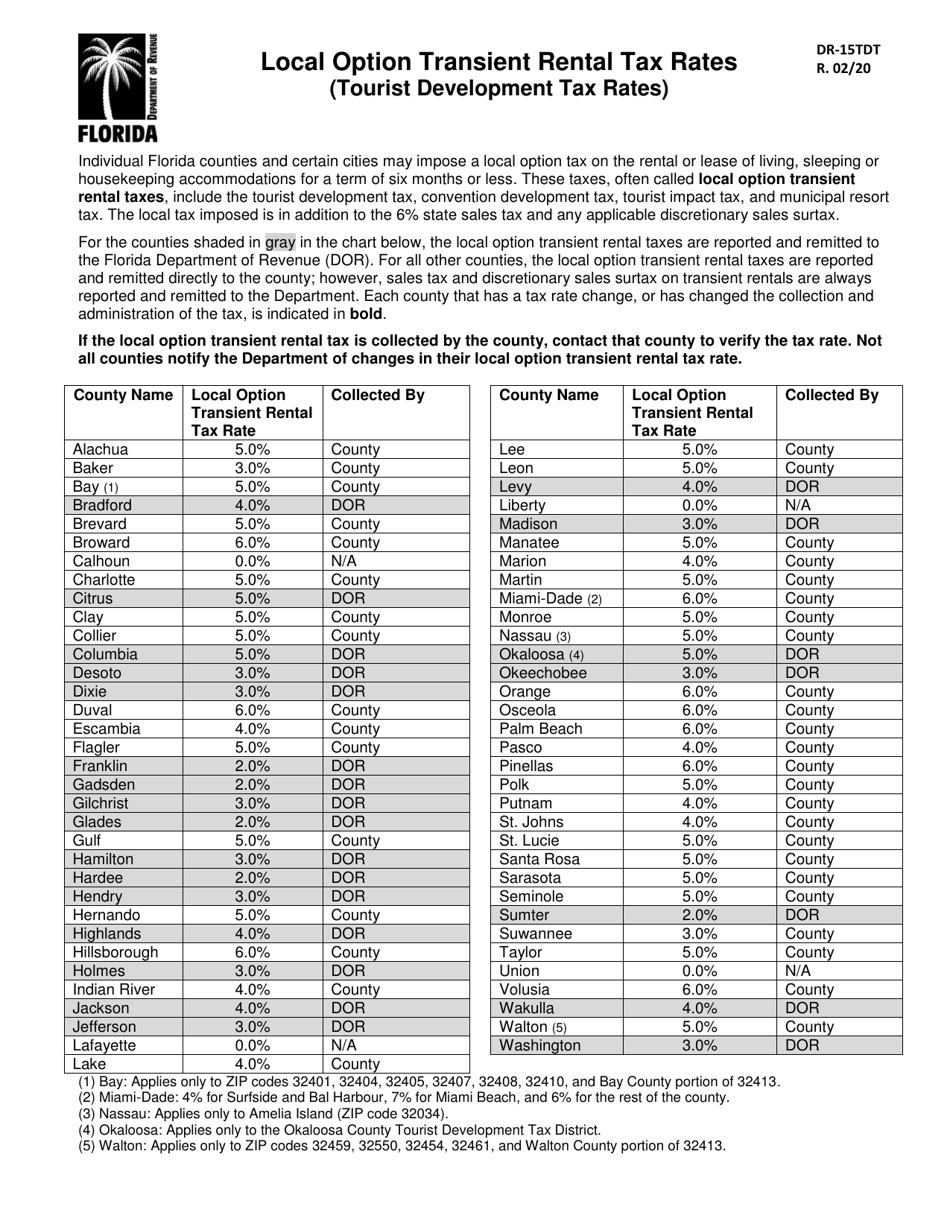

Form Dr 15tdt Download Printable Pdf Or Fill Online Local Option Transient Rental Tax Rates Tourist Development Tax Rates Florida Templateroller

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

File Sales Tax By County Webp Wikimedia Commons

What Is New York S Sales Tax Discover The New York Sales Tax Rate In 62 Counties

New York Sales Tax Rates By City County 2022

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com

Strictly Business New York State S Over Dependence On Property Taxes

Florida Sales Tax Rates By City County 2022

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

New York Sales Tax Guide And Calculator 2022 Taxjar

Florida Dept Of Revenue Property Tax Data Portal

Florida Sales Tax Small Business Guide Truic

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com